A forum on climate change held last Wednesday in Richmond was supposed to be about moving to clean energy, but it sometimes seemed to be more of a platform for Governor Terry McAuliffe to tout plans for more natural gas and nuclear energy in the Commonwealth. It wasn’t that he neglected energy efficiency, wind and solar—he had plenty of good things to say about these, and even a few initiatives to boast of. It was just that they paled against the backdrop of massive new natural gas and nuclear projects, to which he seems even more firmly committed.

The event was a conference called “The Next Frontier of Climate Change,” organized by The New Republic magazine and the College of William and Mary. Moderator Jeffrey Ball of Stanford University shaped the conference as a series of interviews, beginning with Governor McAuliffe. You can see video of the interview here.

Ball started out asking about the politics of climate change, which gave McAuliffe a chance to reiterate his convictions that climate change is real, that we can see it happening today in Hampton Roads, and that part of meeting the challenge involves supporting the kind of 21st century technologies that will also make Virginia an exciting and attractive place to live. That includes offshore wind and solar.

But McAuliffe also made it clear he sees everything through the lens of economic growth, and his top priority is attracting new business to fill the gap left by shrinking federal spending in the state. “When I ran for governor,” he explained, “I tried to put everything in an economic issue: what is good for the Commonwealth, how do you grow and diversify. I preside over a commonwealth that, we are the number one recipient of Department of Defense dollars, number one. Now, that’s great when they’re spending, but when they’re cutting like they’re cutting today, it has a dramatic impact.”

He is also persuaded that renewable energy, even with all its job benefits, won’t get him as much economic growth as cheaper fossil energy can, and his friends at Dominion Resources and its subsidiary, Dominion Virginia Power, have convinced him that means backing their plans for natural gas and nuclear.

McAuliffe said he supports EPA’s Clean Power Plan, and said in the course of the interview that he thought it would result in lower electricity rates for Virginians over the long run; but he’d still like it to demand less of our utilities. He echoed assertions from legislators and utilities that the draft plan’s treatment of existing nuclear plants makes it “unfair” to Virginia. Repeating a line that is now standard among Virginia politicians, he claimed the Clean Power Plan doesn’t give us “full credit” for reducing our carbon emissions by building nuclear reactors back in the 70’s. He has been raising the issue with the Obama Administration, and feels confident EPA will make the changes he requested.

Neither McAuliffe nor anyone else has explained why we should get credit for doing something 40 years ago for entirely different reasons, at a time when very few people had climate change on their radar screens. But never mind that; according to this theory, which he asserted again at the conference, the Clean Power Plan’s failure to credit us for our nukes puts us at a disadvantage compared to coal-heavy states like West Virginia and Kentucky that haven’t done diddley-squat.

(You know, I hope someone is passing all this along to the folks in West Virginia and Kentucky, who have been screaming bloody murder about how tough it will be for them to comply with the Clean Power Plan. I don’t get the sense they are aware they have this terrific advantage over Virginia and can expect shortly to begin luring away our businesses. Mitch McConnell, for one, seems entirely oblivious of the favor the EPA is doing his state. What a shame it would be if all of McConnell’s anti-EPA rhetoric were based on a simple misunderstanding!)

Maybe our governor needs to put a few items on his reading list, like the PJM analysis that shows the Clean Power Plan puts Virginia at an advantage over neighboring states, especially if it joins a regional compliance program. He should also check out a new report from Virginia Advanced Energy Industries Coalition and the Advanced Energy Economy Institute that describes the tremendous job growth in renewable energy and energy efficiency that will flow from compliance with the Clean Power Plan. Given the opportunities presented, the Governor should embrace more stringent goals, and should look to clean energy rather than nuclear as the money-saving, job-creating approach to compliance.

However, McAuliffe’s enthusiasm for nuclear goes beyond using it to wangle a softer carbon reduction target out of the EPA. He told Ball repeatedly that he is a “huge fan” of nuclear energy, thinks a new nuclear plant should be part of Virginia’s compliance with the Clean Power Plan, and expressed delight over Dominion’s plans for a third reactor at North Anna.

And yet, when confronted with a question from the audience about the wisdom of building another nuclear plant on an earthquake fault line, he said cheerfully that the Nuclear Regulatory Commission won’t approve a plant that isn’t safe. Worrying about it isn’t his job.

We’d better hope his confidence in the NRC is well placed—and hope too that the NRC successfully resists the political pressure to approve the plant that it will no doubt receive from Governor McAuliffe.

Ball suggested that what was behind the question on nuclear was a contention that if the state ramped up its investments in efficiency and renewable energy it would not need to build a new nuclear plant. McAuliffe assured Ball that wind, solar and efficiency couldn’t do that yet. He knew that because—ahem—he’d heard it from Dominion.

I guess no one has told the Governor that asking Dominion for its take on efficiency is like asking Exxon about electric cars.

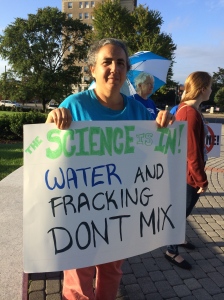

McAuliffe’s enthusiasm for big projects that promise more business for Virginia (and Dominion) has also caused ongoing friction between the Governor and members of the public over natural gas pipelines. This led to the incident at the conference that grabbed headlines, with an angry protester trying to shout down the Governor.

At issue was McAuliffe’s support for Dominion’s controversial Atlantic Coast Pipeline. The proposed 550-mile natural gas transmission project will require the seizure and clear-cutting of a 125-foot wide right-of-way across Virginia from West Virginia to the coast in North Carolina, through national forests and private land. And of course, it will increase Virginia’s carbon footprint by enabling the burning of more fossil fuel here.

Pipeline opponents had brought into the New Republic event a banner reading “McAuliffe: Pipeline will be Climate Chaos.” During the Q&A period the protester reminded McAuliffe that he had once opposed natural gas fracking in Virginia.

But McAuliffe remained unruffled even as the protester hurled insults at him, until she was escorted from the room. “We’re not doing the fracking here,” he said, by way of explaining his support for the pipeline. “The fracking is done elsewhere. I’m not, as the governor of Virginia, going to stop fracking in America today.” Therefore, he concluded, we might as well take advantage of the fracking going on elsewhere to “bring cheap gas to parts of Virginia that can open up and build the economy.”

It seemed no one had alerted him to research indicating the gas boom will start to go bust just five years from now. If that happens, of course, higher gas prices will make the Governor’s manufacturing renaissance go bust, too, leaving Virginia worse off than before. Coupled with Dominion’s plans to bring online a staggering 4,300 MWs of new natural gas generating plants by 2019, Virginia is putting itself at the mercy of a natural gas market that is entirely outside our control.

But when I asked the Governor if he wasn’t worried about the risks of over-investing in natural gas, he shrugged off the concern. It’s not his job to review Dominion’s plans, he said.

Well, sure. But there’s a problem with cheerleading for every big energy project that comes along and taking no responsibility for their downsides. This is the “all of the above” strategy that brought us the climate crisis. From a governor who knows climate change is happening before our eyes in Virginia, we’re still hoping for better.