For the past few years, observers have been warning that the huge surge in demand for electricity to serve data centers will mean higher electricity bills. In its December 2024 report on data centers in Virginia, the Joint Legislative Audit and Review Commission (JLARC) confirmed projections that the increased demand for power and the need for new infrastructure to serve data centers would raise rates for everyone, not just the data centers.

Right on cue, on March 31 Dominion Energy Virginia filed a request with the State Corporation Commission to increase the rates it charges to all customers. If granted, the increase would amount to an additional $10.50 on the monthly bill of an average resident. In a separate filing on the same day, Dominion asked to increase residents’ bills by another $10.92 per month to pay for higher fuel costs.

Either out of a monumental failure to read the room, or because Dominion executives feel they might as well be hung for a sheep as a lamb, the rate filing also asks for an increase in the company’s authorized rate of return, from 9.7% currently to 10.4%.

But it’s not all bad news. Along with the rate increase request, Dominion filed a proposal to create a new rate class for large-load customers like data centers. The move coincides with enactment of new legislation requiringthe SCC to examine whether electric utilities should separate data centers into their own rate class to protect other customers, something the SCC was in fact already doing.

And Dominion is not alone. Virginia’s other major investor-owned utility, Appalachian Power, filed a similar proposal on March 24, following onefrom Rappahannock Electric Cooperative (REC) on March 12. The proposals reflect a growing consensus that ordinary residents should not be forced to bear the cost of building new infrastructure needed only because of data centers. Moreover, if data centers close up shop before the costs of the new infrastructure are fully paid for, residents should not get stuck paying off these now-stranded assets.

In Dominion’s case, there is good reason to worry. In the first day of testimony at the SCC regarding the company’s 2024 Integrated Resource Plan (IRP), a Dominion witness admitted that of the $7.6 billion worth of planned new transmission infrastructure listed in the IRP, residential customers will pay 55%, including for infrastructure that serves only data centers.

It’s not immediately clear how much setting up a new rate class for data centers will change that outcome. Dominion proposes creating a new large-load class for customers using at least 25 MW at capacities of 75% or more (meaning that they have a consistently high level of electricity use, as data centers do). These customers would be subject to a number of new requirements, including posting collateral and paying for the substation equipment that supplies them. They would also have to sign 14-year contracts (including an optional 4-year ramp-up period) obligating them to pay for the greater of actual electricity use or 60% of the generation and 85% of the transmission and distribution capacity they sign up for, even if they use less.

Dominion says the proposed generation demand charge is much lower than that for transmission because transmission and distribution assets must be designed for 100% of capacity, while generation is only planned for 85% actual metered load. Based on that, though, you might think the correct demand charges would be set at 100% for transmission and 85% for generation. It’s also not clear whether 14 years is long enough to recover all the costs incurred to build new infrastructure, or whether that’s even the outcome Dominion is striving for.

There are sure to be a lot more of these kinds of questions when the SCC takes up Dominion’s rate case. The SCC will have to evaluate Dominion’s proposed large-load tariff against a worst-case scenario: an industry-wide disruption that suddenly and dramatically reduces data center demand across the state, leaving a utility with excess generation and transmission capacity that can’t be backfilled and that other customers will be stuck paying for.

Fortunately, Dominion’s proposal doesn’t have to be considered in isolation, since the SCC will be able to compare it to those from APCo, REC and utilities in other states. According to APCo’s filing, its new rate class would be limited to the largest new customers (those with at least 150 MW in total or 100 MW at a single site). These customers would be required to pay a minimum of 80% of contracted demand even if they use less, which the company says is a significant increase from the demand charge of 60% that applies to existing customers. (You’ll notice it’s also a lot more than the 60% demand charge Dominion is proposing for data centers.)

APCo’s filing notes that its proposal is consistent with a data center tariff it recently agreed to in settling a case in West Virginia; in both cases, customers would have to sign 12-year contracts, following an optional ramping-up term of up to 4 years, with requirements for posting collateral and stiff exit terms.

APCo has other experience to go on as well. Its parent company, American Electric Power (AEP), made news when its subsidiary in central Ohio proposed to charge data center customers at least 90% of contracted demand or 90% of their highest demand over the preceding 11 months, whichever is higher, and committing them to contract terms of at least 10 years, after a ramp-up period of up to four years. Data centers pushed back hard on these terms, and the Ohio Public Utilities Commission is considering different settlement proposals with somewhat lower demand charges.

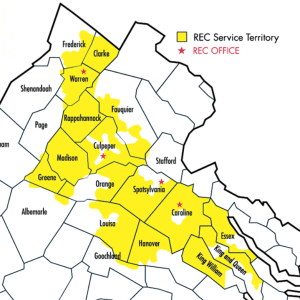

REC’s filing takes an entirely different approach. REC is the largest of Virginia’s co-ops, serving a territory that stretches from Frederick County in northwest Virginia down through Spotsylvania and as far east as King William County. As data center development pushes outward from Northern Virginia, REC finds itself overwhelmed with new demand. It now expects up to 17 gigawatts of data center demand by 2040, up from near zero in 2023, dwarfing all other customers’ loads.

Like other utilities, electric cooperatives have an obligation to serve all comers in their territory, so if a new data center moves in, they have to provide the power. But unlike Dominion and other investor-owned utilities, co-ops are customer-owned nonprofits. They are highly motivated to protect their existing customers from the costs – and risks – involved in serving new ones.

REC is a distribution cooperative only, with no generation of its own. Today, REC gets all its electricity from Old Dominion Electric Cooperative (ODEC), a sort of umbrella organization that owns generating plants and supplements those with power purchased on the PJM wholesale market. But when ODEC learned how much new data center load REC was expecting, it told REC to look elsewhere for the power.

REC’s solution is to silo off big data centers and other customers with more than 25 megawatts in demand, and keep all the costs and risks involved within that space. According to the proposal the co-op filed with the SCC, data centers that want to get power from REC will have to post collateral, contribute to the cost of new infrastructure and sign two agreements, one for the power supply and one for its delivery. REC (or an affiliate it plans to create for this purpose) will buy electricity from PJM on the open market and pass through the cost. Alternatively, the data centers will be able to buy electricity from competitive service providers, allowing them, for example, to procure renewable energy.

REC’s proposed delivery contract is similarly designed to ensure the data centers pay all the grid costs the utility will incur in serving them. In addition to contributing to the cost of new infrastructure, data centers will have to sign contracts with terms that must “be structured to recover the full cost of distribution and/or sub-transmission plant investment, maintenance and operation.” This includes payment of a demand charge that isn’t specified but appears to be as high as 100% of peak demand – meaning, there would be no risk that these grid costs would end up on the tab of residents and other customers outside the class.

REC’s approach might be seen as a sort of gold standard for protecting other ratepayers from the costs and risks involved in providing energy to data centers. It’s not a perfect antidote for rate increases, because the tight supply of generating capacity within PJM is already pushing up costs of electricity even for existing customers. And buying electricity on the open market may cost data center customers more than buying it from a utility that owns its own generation, as Dominion and APCo do. But that isn’t a concern that will keep REC’s other customers up at night.

The very different approaches proposed by REC, on the one hand, and Dominion and APCo, on the other, reflect the difference between a nonprofit distribution cooperative and investor-owned utilities that build and own generation. Building stuff is how investor-owned utilities earn a profit. The bigger their customer base and the more electricity those customers demand, the more the profit. The data center industry looks to them like a big, fat golden goose.

It isn’t surprising, then, that neither Dominion nor APCo are proposing solutions that put all the risks involved with serving data centers onto the industry, the way REC’s proposal does. As a new Harvard Law School reportdetails, the utility profit motive and the political muscle of Big Tech inevitably lead to a cost shift onto other customers.

Maybe there is something different about data centers in Virginia that justifies involving ordinary residential customers in this risk. Dominion will surely make that pitch when the SCC takes up the case.

It will be interesting to observe, but color me skeptical.

Originally published on April 25, 2025 in the Virginia Mercury.