The Virginia General Assembly will soon wrap up its work on the 2013 legislative session. Renewable energy advocates began the session with high hopes for a series of bills that promised to reform our renewable energy law, expand net-metering, and open up new opportunities for financing solar systems and small wind turbines.

So how did we do? Well, this is Virginia. Progress is slow, the utilities are powerful, and half the legislature doesn’t believe in climate change. On the other hand, they do believe in business. Under the circumstances, we did okay.

Renewable Portfolio Standards: bye-bye, bonuses

Readers of this blog already know the long, miserable tale of Virginia’s weak and ineffective, voluntary renewable portfolio standard (RPS), which has enriched utilities with tens of millions of dollars in incentives without bringing any new renewable energy projects to Virginia. This year the legislature went halfway to fixing the problem. Legislation negotiated between the office of the Attorney General and the utilities will deprive utilities of future ill-gotten gains for meeting the RPS law, but won’t change the pathetic nature of the law itself.

Stripping out the RPS incentives was only part of a bigger, more complex bill that sweetens the deal for utilities in other ways, so it’s hard to judge whether the legislation as a whole marks a victory for consumers. Skeptics will note that Dominion’s stock price has actually gone up several percentage points since the deal was announced, which you wouldn’t expect if the AG were correct that the bill will save consumers close to a billion dollars over time.

What is clear is that the RPS remains as voluntary and as crummy as it ever was, but the utilities can no longer use it to rip off ratepayers while pretending to be good citizens. Some environmental groups consider stripping out the incentives a bad thing, on the theory that only by giving utilities a bonus can we expect them to meet the goals. Other groups (including the Sierra Club) believe Dominion, at least, will want to maintain its greenwashed public image by continuing to meet the RPS goals, and that ending the consumer rip-off is worth celebrating.

Sure, if the goals had brought wind and solar to Virginia, the Sierra Club would have considered the incentives a tolerable price to pay. As it happened, Dominion and the other utilities continuously rebuffed efforts over the years to improve the RPS. Had Dominion approached the RPS as an opportunity to bring real renewable energy to Virginia rather than as a cash cow to be milked for its own advantage, the company would have saved itself a public relations fiasco and likely kept its bonuses, too. Surely, someone at HQ should be out of a job right now.

Taking the long view, it is also worth noting that getting rid of the free money is a necessary first step towards a mandatory RPS in Virginia, which would unleash market forces for renewable energy that don’t emerge with a voluntary law. Utilities would oppose such a move more vigorously if they still had incentives to protect that were available only under the voluntary program.

. . . but reform efforts fail again

These views all assume the legislature will someday pass a bill to improve the goals and bring wind and solar projects to Virginia, without which the RPS is meaningless anyway. Surely legislators must recognize how pointless it is to have an RPS that can be met with out-of-state, pre-World War II hydro, plus some trash and wood-burning and a few assorted projects that put no power on the grid. (Even without the performance incentives, utilities remain entitled to pass along to customers the cost of meeting the RPS goals.)

Bills to improve the goals should have passed the legislature this year as part of the reform package. HB 1946 (Lopez) and SB 1269 (McEachin) even received the support of Dominion Power for provisions that would limit most future purchases for the RPS to high-quality projects like wind and solar. What killed the bills seems to have been a combination of opposition from vested interests and sheer cussedness on the part of some Republicans, who were engaged in partisan maneuvers that had nothing at all to do with renewable energy.

As usual, we are left hoping for better luck next year. Meanwhile, however, a couple of other RPS bills made incremental progress. Most notably, HB 1917 (Surovell) adds solar thermal energy to the definition of renewable energy; as of this writing it has passed the House and is on the Senate floor.

A loss for more honest competition among fuels

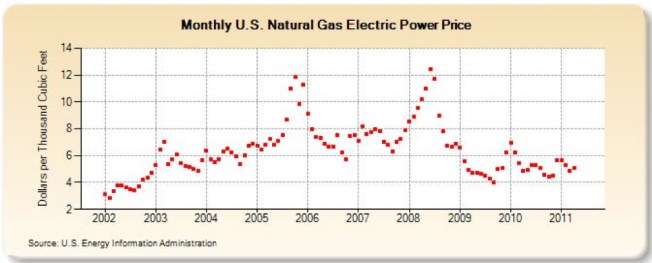

There are more ways to support renewable energy than through an RPS, of course. One of my favorite bills would have required utilities and the State Corporation Commission to consider the long-term price stability of fuels used in electric power generation. HB 1943 (Lopez) would have helped price-stable wind and solar compete against notoriously price-volatile natural gas. It’s an idea that should appeal to fair-minded conservatives, so it’s a shame it hasn’t gained traction since first being introduced in 2012. However, it died in committee in the face of opposition from Dominion Power, which doesn’t want any interference with its plans for new natural gas plants.

Power Purchase Agreements get a “pilot”

Two bills passed the legislature to allow some third-party power purchase agreements (PPAs) for wind and solar within Dominion’s territory. Under a PPA, an installer retains ownership of the solar equipment, with the customer buying the electricity that is generated. This arrangement has two primary advantages: the customer can “go solar” with no money down and no responsibility for the equipment; and in the case of a tax-exempt entity like a church or a university, it provides a way to access federal tax credits worth 30% of the system cost.

The bills were designed to prevent a recurrence of a dispute that erupted in 2011 when a Staunton-based solar company, Secure Futures, installed a large solar system at Washington & Lee University under a PPA. Dominion issued “cease and desist” letters insisting that only it could sell electricity in its assigned territory. Although Virginia law is unclear on this point, the university and the solar company capitulated in the face of massive litigation costs. Since then Dominion’s army of lawyers has proven as effective as any statute in stopping further efforts to use PPAs in Virginia.

This year’s bills, SB 1023 (Edwards) and HB 2334 (Yancey), were originally written to allow third-party PPAs wherever customers can currently install renewable energy systems that they own themselves. They were significantly scaled back to win acceptance from Dominion Power. (AEP and the coops wouldn’t play at all, so legal ambiguity remains the rule in their territories.)

The bills allow up to 50 megawatts’ worth of solar and wind installations using PPAs, in Dominion territory only, as a pilot program. Whether net-metered or not, they will be counted against the current net-metering cap of 1% of the utility’s generation. Tax-exempt entities can have a facility of any size up to 1 megawatt (500 kW if they net meter); taxable entities must have a minimum size of at least 50 kW (so no homeowner need apply). PPAs that do not meet the requirements are expressly prohibited in Dominion territory.

Agricultural net metering, yes; community net metering, no

A bill to allow agricultural net metering also passed this year. HB 1695 (Minchew) allows the electricity from a single solar, wind, or digester gas facility to be attributed to two or more electricity meters as long as they are all on the same property and have the same owner. Thus, for example, a farmhouse, barn and other out-buildings can all share in the benefits of solar panels on one of the buildings, even if each building is separately metered.

Originally the bill would also have enabled community net metering, sometimes known as solar gardens, but the utilities opposed it. Bowing to political reality, Delegate Minchew scaled it back. The bill is notable, however, for making progress without including any provisions that seem capable of doing mischief.

A note about all the bills: In Virginia, the governor can sign a bill, veto it, or send it back to the legislature with amendments of his own, so none of these bills are final as of this writing.